Most countries in the world levy a value added tax, sales tax or similar, although the tax rates can be very different. Read more in our article, why Switzerland is so attractive for businesses in terms of the VAT.

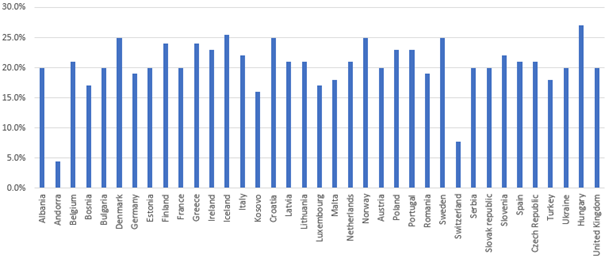

Most countries in the world levy a value added tax, sales tax or similar, although the tax rates can be very different. These range up to 50% (Kingdom of Bhutan in South Asia; probably the highest in the world). In the EU, regular VAT rates are around 20% (e.g. Luxembourg 17%; Germany 19%, Hungary 27%). The regular VAT rate of 7.7% in Switzerland is thus one of the lowest in the world and almost the lowest in Europe.

Source chart: MME Tax AG

Switzerland as a location with a low VAT rate has advantages for entities for which VAT becomes a final charge because due to the specific business activity no full input VAT claim is possible.

Switzerland is an interesting location in particular for the following business activities, which do not qualify for (full) input VAT claim:

Factoring Business

Factoring entities that buy receivables from other parties and then collect these receivables (worldwide). The factoring business with the assumption of the default risk does not give the right to input VAT claim. The costs for collecting the receivables (e.g. foreign third party collecting firm) are subject to a final Swiss VAT charge of "only" 7.7% (unlike other countries with e.g. 20% VAT rate).

Treasury/Cash Pool/Cash Management

Entities providing treasury, cash pooling, cash management and comparable services and acting as counterparty (e.g. physical cash pooling). These activities lead to VAT-exempt turnover without the right to claim input VAT. Since the input VAT in Switzerland is "only" 7.7% (in contrast to other countries), this results in a competitive advantage.

Holding companies

Holding companies holding investments in subsidiaries. According to Swiss VAT law, this is considered a commercial activity and the holding company can therefore be registered in the Swiss VAT register and is basically able to claim input VAT in line with its commercial activity.

Entities that receive (substantial) subsidies

Entities that receive subsidies from public authorities (also from outside Switzerland) must reduce their claimed input VAT accordingly. This leads to final VAT costs, which is lower in Switzerland than abroad due to the lower VAT rate.

Insurance and reinsurance

Entities whose turnover is based on the sale of insurances and reinsurances. These sales are exempt from VAT and do not qualify for input VAT claim. The entity therefore has final VAT costs. The low VAT rate (of 7.7%) in Switzerland therefore provides a market advantage.

Switzerland's low VAT rate leads to lower costs and thus increases the entities' competitiveness.

Therefore, the VAT aspects should be taken into account when choosing a location in course of e.g. a restructuring and setting up the above-mentioned businesses. In this context, other advantages that make Switzerland an interesting location can also be mentioned: e.g. Switzerland is located in the heart of Europe; there is an international culture and the relationship with the various authorities is straightforward.

MME offers advice as well as competent and goal-oriented support e.g. for an initial assessment and a possible subsequent restructuring, set-up of business, etc.