What social insurance schemes exist in Switzerland and who is subject to them? What social security deductions must be expected when a company is to be founded in Switzerland? What else should be considered or recommended?

Example: An IT company based in Germany plans to establish a subsidiary in Switzerland. In addition to new employees, several existing employees are to work for the subsidiary. The latter are concerned not to lose their previous level of social security protection.

Q: What social insurances are there in Switzerland?

A: There is a well-developed network of social insurances that provide financial protection against risks for people living and/or working in Switzerland and their dependents. This includes the following areas:

Q: Who is subject to social insurance in Switzerland?

A: Social insurance covers natural persons who are resident in Switzerland and/or who are gainfully employed in Switzerland. In the case of cross-border employment, numerous social security agreements apply between Switzerland and various countries. As a rule, they are subject to the social security system of the country in which the gainful activity is carried out. There are numerous special provisions which must be considered in the specific case. The so-called Agreement on the Free Movement of Persons applies between Switzerland and the EU. If the employees who were previously working in Germany become active for the subsidiary in Switzerland, they and their non-employed family members are in principle subject to the Swiss social security system from this point on. This applies regardless of whether they work in Switzerland as cross-border commuters or whether they take up residence. Exceptions exist, for example in the case of a temporary posting. The agreement on the free movement of persons provides for temporary stays of up to two years, but upon request, this may be extended to up to six years. In such case, it is possible to avoid being subject to the Swiss social security system by presenting an A1 certificate.

Q: What social security deductions must be expected if a company is to be founded in Switzerland?

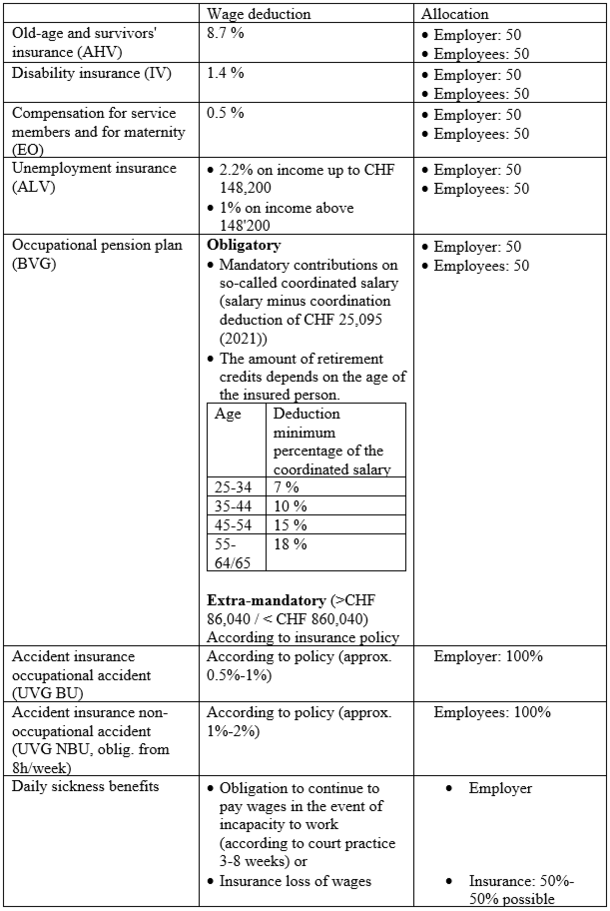

A: Social security deductions are primarily financed by contributions from earned income, levied as a percentage of income. In principle, the contributions are divided equally between the employee and the employer, although the employer may pay more. The mandatory contributions are as follows (as of January 1, 2021):

There are no deductions according to salary percentages for health insurance. Each insured person is responsible for this and pays a monthly premium. The family allowances, in particular the child allowance of at least CHF 200, are transferred by the employer but reimbursed by the state.

Q: What happens if the workers have more generous social coverage in the country of origin and this should be maintained?

A: Grundsätzlich verfügt die Schweiz über ein grosszügiges soziales Netz. Je nach Sozialversicherung und persönlicher A: In principle, Switzerland has a generous social safety net. However, depending on the social security and personal situation, it can of course happen that selective adjustments are desired. There are various possibilities here, depending on the area in which and the reason for which social protection is to be improved. For example, the above distribution can be adjusted to the extent that the employer can take over more than the legally required distribution (whereby any tax consequences must be taken into account). Likewise, contributions to the occupational pension plan (BV) can be increased, whereby certain requirements must be met. And finally, insurance companies offer supplementary insurance to specifically improve the statutory minimum protection.

Our insurance law experts will be happy to advise you on all social security issues in connection with your move to Switzerland and independently of it. We look forward to hearing from you.

You can find more information on the topic of "Moving to Switzerland" in our free whitepaper.